- Local authorities

- Tertiaire privé

Idex speeds up its growth with two large contract wins in district heating and solar PV power

Idex, a leading player in local energy transition, announces that it has signed agreements for two large projects that will solidify its position in the French market: one to build a district heating network that will expand the greater Bordeaux area's existing system, the other to launch a strategic France-wide partnership with Amundi Immobilier, a real estate asset manager. Both contracts showcase the Group's ability to handle substantial long-term investment projects to decarbonise cities, regions and real estate.

Métropole Sud Énergies: a first-class infrastructure asset for the Bordeaux area

Idex and Mixéner (the subsidiary it jointly owns with Bordeaux Métropole Énergies) have been awarded the concession on the Métropole Sud Énergies district heating network. The project will play a pivotal role in the area's energy system and is a perfect fit for the Group's expertise in high-complexity infrastructure with a substantial positive impact on the environment.

-

A large-scale investment: the cost of the works will amount to €134 million – 20% of Idex's total annual investment – and involve building nearly 40 km of new networks to heat the equivalent of more than 20,300 homes across the southern part of Bordeaux's metropolitan area.

-

Best-in-class environmental performance: the network will supply over 200 GWh of heat generated from a novel and entirely renewable mix (41% local biomass and 36% geothermal energy, as well as green electricity and biomethane).

-

Long-term commitment: underthis multi-year concession contract, Idex guarantees the heat's very low carbon intensity (30 gCO2e/kWh) and price stability for users through long-term supply agreements.

Amundi Immobilier: third-party investment for business premises

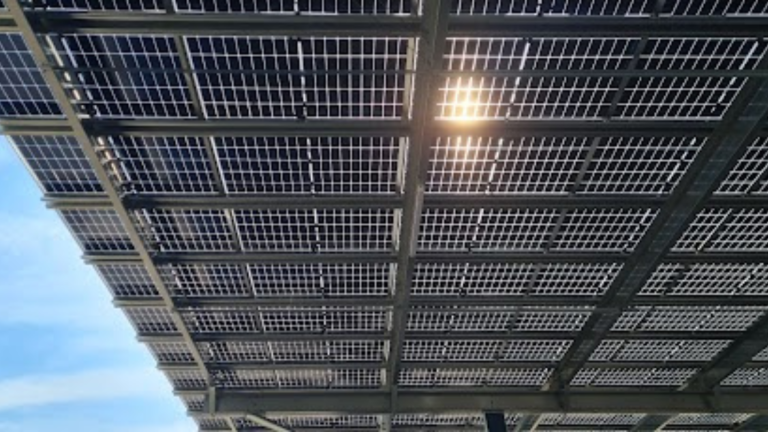

Meanwhile, Amundi Immobilier selected Idex to roll out an extensive solar-powering and e-mobility programme across its property portfolio in France. Idex won this contract on account of its agility enabling it to deploy decentralised solutions throughout the country.

-

A capital-light business model: as a third-party investor, Idex will finance and operate the systems for 20 years, enabling Amundi Immobilier to decarbonise its assets faster without allocating its own capital.

-

A large-scale deployment: the partnership agreement covers more than 80 assets and Idex has been entrusted with a substantial portion, representing one-third of the total capacity, i.e. approximately 20 MWp (8 MWp on carports, 12 MWp on rooftops). It will install this capacity across some 20 retail, office and logistics premises, and hotels.

-

Synergising solar energy and mobility: in addition to photovoltaic power production systems, Idex will set up more than 150 charging stands for electric vehicles at retail, office, logistics and hospitality premises, strengthening its integrated Connected Parking programme.